change in net working capital as a percentage of change in sales

Setting up a Net Working Capital Schedule. For year 2020 the net working capital is 10000 20000 Less 10000.

The business would have to find a way to fund that increase in its working capital asset perhaps by selling shares increasing profits selling assets or incurring new debt.

. Its primary benefit is measuring the amount of working capital needed or to specify the size of working capital requirements. So a positive change in net working capital is cash outflow. Secondly the coming years sales forecast is.

Net working capital is also known simply as working capital. Although borrowing money to finance new equipment or other initiatives to help increase sales is not bad on its own a company must still be able to easily pay down its. If a company sells merchandise for 50000 that was in inventory at a cost of 30000 the companys current assets will increase by 20000.

First each component of working capital as a percentage of sales is calculated. The change in working capital value gives a real indication on why the. A change in working capital is the difference in the net working capital amount from one accounting period to the next.

Companies may over stock or under stock because of expectations of shortage of raw materials. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. If no other expenses are incurred working capital will increase by 20000.

Change in Working capital does mean actual change in value year over year ie. For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft. And it helps determine this amount based on the total revenue or sales from an operation.

Compare the ratio against other companies in the same industry for additional. Its also important for predicting cash flow and debt requirements. Owner Earnings 8903 14577 5129 13312 2223 13084.

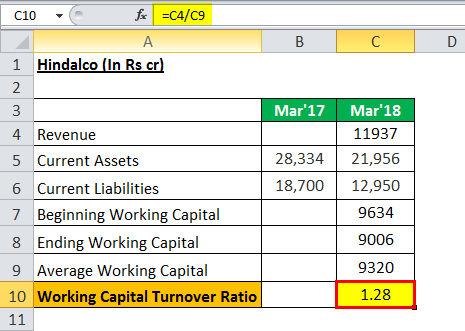

In general the higher the number the more financial risk is involved in company operations as it takes a higher degree of assets to run short-term operations. The sales to working capital ratio is calculated by dividing annualized net sales by average working capital. Calculation of the Sales to Working Capital Ratio.

Finance questions and answers. Working capital as a percent of sales is calculated by dividing working capital by sales. You could allow working capital to decline each year for the next 4 years from 10 to 6 and once this adjustment is made begin estimating the working capital requirement each year as 6 of additional revenues.

Now changes in net working capital are 3000 10000 Less 7000. Working Capital to Sales. Changes in working capital are reflected in a firms cash flow statement.

NWC is a way of measuring a company. Working capital as percent of gross revenues indicates how much working capital your farm business may need. Net Working Capital Cash and Cash Equivalents Marketable Investments Trade.

In this case the change is positive or the current working capital is more than the last year. If a transaction increases current assets and. Change in Net Working Capital 12000 7000.

Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow. Such a trend line is an excellent feedback mechanism for showing management the results of its decisions related to working capital.

Changes in working capital -2223. But it means the change current assets minus the change current liabilities. The percentage of sales method is the simplest and easiest way of finding future working capital.

Net working capital is defined as current assets minus current liabilities. For instance if a companys current liabilities are 1890000 its current assets are 2450000 and its total assets equal 3550000 the company can find its net working ratio like this. Below are the steps an analyst would take to forecast NWC using a schedule in Excel.

Hence there is obviously an assumption that working capital and sales have been accurately stated. To calculate net sales subtract returns 400 from gross sales 25400. For working capital add the accounts receivable 8333 and inventory 12500 then subtract accounts payable 1042.

Therefore working capital will decrease. For accounts payable are 20 million and sales are 100 million accounts payable as a percentage of sales would be 20. Its a calculation that measures a businesss short-term liquidity and operational efficiency.

What is NWC formula. If a business has high operating leverage then there. The net working capital NWC formula is.

The formula is working capital divided by gross sales times. Now lets break it down and identify the values of different variables in the problem. Thus if net working capital at the end of February is 150000 and it is 200000 at the end of March then the change in working capital was an increase of 50000.

Similarly change in net working capital helps us to understand the cash flow position of the company. The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements. For the year 2019 the net working capital was 7000 15000 Less 8000.

Net working capital NWC is current assets minus current liabilities. The higher a companys working capital as compared to sales the better off and more stable the company is financially. 19 _____ A NWC changes in direct relation to sales but the change may be less than proportional with sales.

It means the change in current assets minus the change in current liabilities. The NWC relative to sales varies by industry as net working capital can represent 2 of sales or even 20 of sales. Here are some examples of how cash and working capital can be impacted.

If a company borrows 50000 and agrees to repay the loan in 90 days the companys. For year 2 calculate the change in net working capital as a percentage of year 1. To get a real understanding of the companys operational efficiency we need to look at change in working capital.

If a business requires a lot of current assets to generate sales and those assets are funded by cash then the net working capital as a percentage of sales will likely be high. The working capital to sales ratio shows a companys ability to pay costs related to generating new sales without the need to take on additional debt. At the very top of the working capital schedule reference sales and cost of goods sold from the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss.

Changing working capital does mean actual change in value year over year. The FFSC defines.

What Is Net Working Capital How To Calculate Nwc Formula

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Meaning Formula Calculation

Change In Net Working Capital Nwc Formula And Calculator

Change In Working Capital Video Tutorial W Excel Download

Change In Working Capital Video Tutorial W Excel Download

Interim Financial Statement Template Unique Interim Financial Statements Example Lux Statement Template Mission Statement Template Personal Financial Statement

Change In Net Working Capital Nwc Formula And Calculator

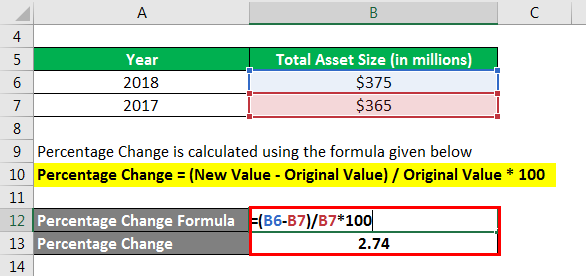

The Percentage Of Sales Method Formula Example Video Lesson Transcript Study Com

Net Working Capital Formula Calculator Excel Template

10 Sample Balance Sheet For Small Business Payment Format Inside Mechanic Job Free Business Card Templates Business Plan Template Business Proposal Template

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

Financial Ratios Calculations Accountingcoach In 2021 Financial Ratio Financial Management Debt To Equity Ratio

Change In Working Capital Video Tutorial W Excel Download

Percentage Change Formula Calculator Example With Excel Template

Profile Of Home Buyers And Sellers Reasons To Buy Real Estate Buying Home Buying Arizona Realtor

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)